Hello and welcome back.

We have officially entered into November and I am already saying to my wife, “This year has flown” while Christmas music is playing in the background.

This is also the last newsletter until a new President takes office, so I am interested to see what next weeks newsletter will look like. I am continuing to pray for leadership, regardless of who takes office.

Big Tech Earnings

The AI investing heavyweights reported Q3 earnings this week, enlightening the public on how revenue and net income grew and what they expect to see in the following quarter/year. It is important to note that stocks move on expectations of earnings. You will only invest in a company to take out more later, what you need to know is how much am I going to get back, when am I going to get it, and how risky will it be.

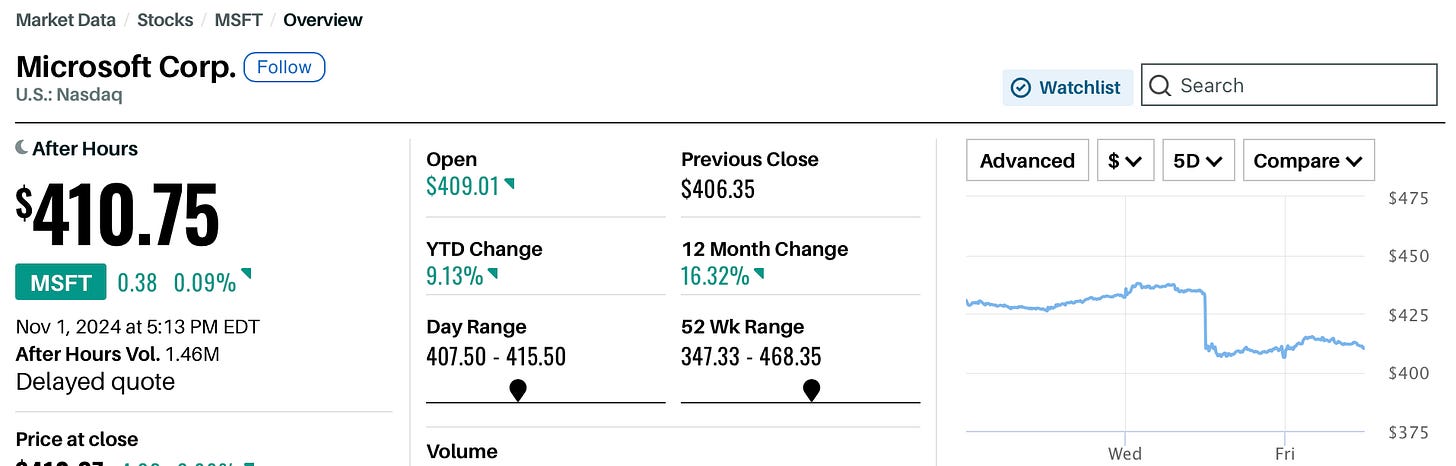

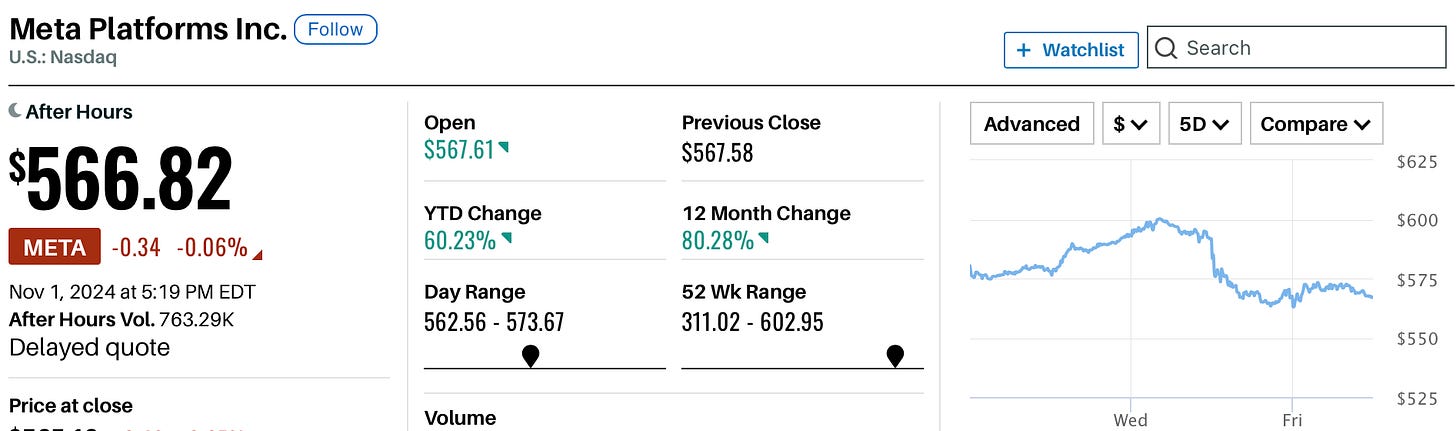

The key point is the word expectations. A stock could crush their estimated earnings per share mark, but if the outlook for the rest of the year is dry, the stock could be in free fall. MSFT 0.00%↑ reported earnings this week beating expectations by 6% (largest beat in over a year) but the company has $200 billion in market cap erased when discussing the further investment into AI still to come. Continued cash burn into AI means less for shareholders. The potential for long term returns on this invested capital is there, but involves risk and less cash to the cloud segment or other proven, profitable business segments. META 0.00%↑ held a similar fate when discussing future cash outlays for investment in AI infrastructure.

If you are looking for exposure to big tech after a quick pullback, a diversified ETF to keep an eye on is XLK 0.00%↑. Currently down for the last month, it offers an interesting entrance opportunity. It is going to be difficult to pick the winner of AI, but you are more likely to capture the secular trend gains in an ETF at a better risk/return profile.

Jobs Data

On Friday, the jobs report showed a 4.1% unemployment rate, consistent with the last reading, showing very stable job market. This month brought strikes from unions such as the dock workers and Boeing employees which led to hiring slowing more than expected. Another factor weighing on the jobs report was both hurricane Helene and Milton making it difficult for businesses to hire and add jobs. The below chart shows only 12,000 jobs were added this month, down from 225,000 last month.

This will be a number to pay attention to, as multiple months or a quarter of job slowdowns would be a leading indicator for unemployment, which leads economic growth.

Inflation Data

The Fed continues to see PCE inflation track down near its target of 2% year over year. On Thursday PCE read 2.1% year over year, down from almost all-time highs of 6%+ in 2022. The Fed has wow’d the world so far by getting inflation under control while not crashing the economy.

There is a lot to be said about the spending from the current administration. Although the markets have remained resilient, we know they have been artificially propped by government deficit spending, which neither presidential candidate seems to be too worried out, and that core growth is a bit more difficult to dig into. It will be important to watch how falling interest rates into the deficit spending will either reignite inflation, or contribute to growth. I will do my best to keep reading and keep you updated.

More Interesting Reading

Neil Postman on the rise of entertainment and the effect on political discourse.

US interest payments exceed $1 trillion

French trader bets $30m on Trump