In this article I wanted to discuss the investing strategy that suits the majority of individuals looking to invest. Although each financial situation is different and has its nuances, dividend growth investing captures the upside of stock price appreciation of a stock, the cash payout of a bond, and the compounding qualities of a business.

How do Dividends Work?

Dividends are a distribution of cash profits from business operations to the owners of the business. The business presents this payment on the statement of cash flows, one of three statements, which is reported to the SEC for investors and compliance. Below is an example from V 0.00%↑ (Visa) on the historic dividends paid to shareholders the last 10 years. Dividends paid have grow from $1 billion to $3.7 billion over this period.

As a shareholder, I will receive the yield on a annual basis. For example, Visa’s yield is currently 0.76% annually. If I multiply this by the stock price of $276 I will receive a dividend of $2.08 each year if I own one share. If Visa pays out quarterly then the I take the yield divided by four and multiply that by the stock price.

Below is an example of Visa’s payout history. As you can see the dividend has grown from about $0.48 per year to $2.08 per year. If I owned 10 shares this would move to $4.80 and $20.80 of course. This represents an 18% compound growth rate over 10 years.

Why Should I Wait?

Let’s take V 0.00%↑ as our previous example.

If you buy one share of Visa for $275, the company will pay you $2.08 this year for owning it. Visa, historically, has grown its dividend 18% every year, and assuming a market growth rate, the stock price will grow 6% a year.

You now have the opportunity to either take the cash and pocket it, or re-invest the cash. What you do should depend on your financial situation and your plan with your advisor, but if you are later in your career, living off the dividend is a very viable option. Dividends are taxed at 15-20% so that would be something to plan for.

If you are earlier in your career, and are looking at a 20-40 year time horizon before retirement, compound interest is about to become your best friend. Lets look at an example, although it will be unrealistic due to the reality that it will be tough to keep these growth rates up for 20+ years.

With the Visa example, you have two engines working to compound your investment. The first is the dividend growth rate, and the second is the stock price. You are paid $2.08 this year and after Visa grows the dividend you will be paid $2.43 next year, without having to buy extra shares.

Now what if you reinvested the $2.08 from last year and bought more shares, thus increasing the dividend you are paid out? If you reinvested your $2.08 for .01 more shares, your dividend increased to $2.45 next year, CRAZY!

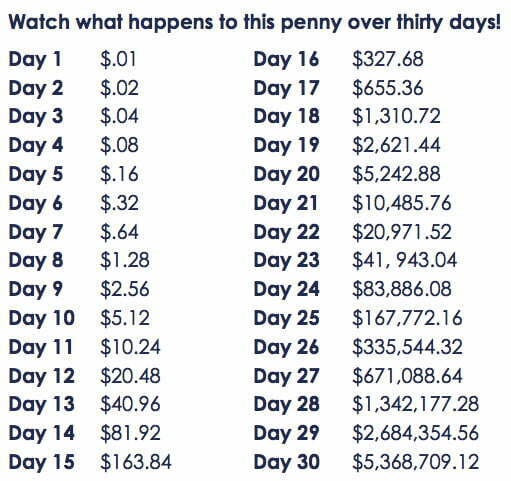

Just kidding, for a while it seems as if nothing is happening. Have you heard the allegory of a kid approached by his dad asking if he would rather have $1 million or a penny that doubles each day for 30 days? If you haven’t, next time someone asks, take that penny, because a penny that doubles for 30 days is actually worth $5.4 million at the end of it. The crazy thing is that by day 27, you still haven’t broken even on the opportunity cost.

Back to Visa - at the end of year 15 your total shares owned would be 1.28 shares, with a dividend of $30, yielding 11% in your original cost of $275.

At the end of year 30 your total shares owned would be 4.21, with a dividend of $1,244, yielding 452% on your original cost of $275.

Lastly, at the end of year 40, you now own 56 shares, receiving $87,572 in dividends, with a yield of 31,845% on your original investment. All you invested was $275.

Together the compounding, after 40 years, results in a CAGR of 34%. That is a heck of an investing career.

This is why Buffett says “Time is the friend of the wonderful business” and “Our favorite holding period is forever”. He also received a dividend check for $4.7 billion in AAPL 0.00%↑ stock this year.

This example was more to show the power of compound interest, especially with businesses growing stock price and dividend, than to recommend Visa or any other stock.

Einstein says “Compound interest is the eighth wonder of the world. He who understands it, earns it ... he who doesn't ... pays it.”

If you want explore more possibilities, see this website.

Where to Find Dividend Growers?

There is a term for companies that grow their dividend year in and year out for over 25 years, they are called Dividend Champions.

Finding good dividend growers can be difficult because it will not work to just buy stocks with the highest dividend yields. Chasing yield can result in buying companies with little to no reinvestment opportunities therefore dropping the stock price and interrupting compounding.

What you want to find is a company that slowly grows the dividend along with its return on invested capital. Most of the time these businesses will be consumer staple or utilities companies, or more mature tech companies. The best firms you can find are ones with opportunities to re-invest capital at high rates while paying you a growing dividend. Study businesses like Visa, Mastercard, Coke (Consolidated, and Proctor Gamble.

Here is a further list of Dividend Champions.

Conclusion

Investing in dividend growth companies can provide exponential income and returns to shareholders if they are willing to be patient and find the right businesses. Finding the right business involves looking at the industry, the competitive advantage, the business model, and management. Patience requires much more, a total sacrifice of short term emotion for long term wealth creation. Even if you are later in your career, having another stream of income in the form of a dividend can be very beneficial, as many dividend growers are less volatile than growth stocks, and they give you the option as to where you want to allocate the cash they give you.

This is not financial advice but it is an attempt to spark conversation and further research.

GO BUCKEYES!