If this is your first time reading these posts, thank you for reading. I have a passion for the markets and people. In writing this weekly post I am able to keep myself accountable by diving deeper into topics than just headlines and hopefully provide you some value in your own research or interests. None of the following should be considered financial advice.

I believe money is a tool, given from God, to accomplish his purposes. The Bible has 2,350 verses about money. How should we handle our money knowing it is a topic of upmost importance to God? Did you know that investing is Biblical? The Bible calls us to be both stewards and multipliers of money (Matthew 25), as well as generously open handed with our money (Proverbs 11), but ultimately the Bible calls us to be on guard against this tool attempting to fill a hole in our heart that only Jesus can fill (James 3 - Exodus 20 - Matthew 6).

Regarding my passion for people, I believe we live in a time period that will be looked back on as an information and entertainment glut. While entertainment in itself is not bad, entertainment in subjects like economics, politics, and public information (news/MSM) is slowly eroding a generations ability to think critically for themselves, me included. Gen Z is now nicknamed “the anxious” generation, due to 6/10 people in this age range reporting significant stress and social anxiety. The places where Gen Z spends the most time are engineered to keep attention, even if it means eroding mental and emotional stability.

I have a big heart for these issues and the generation, but I can only be sure of changing myself first.

Market Update

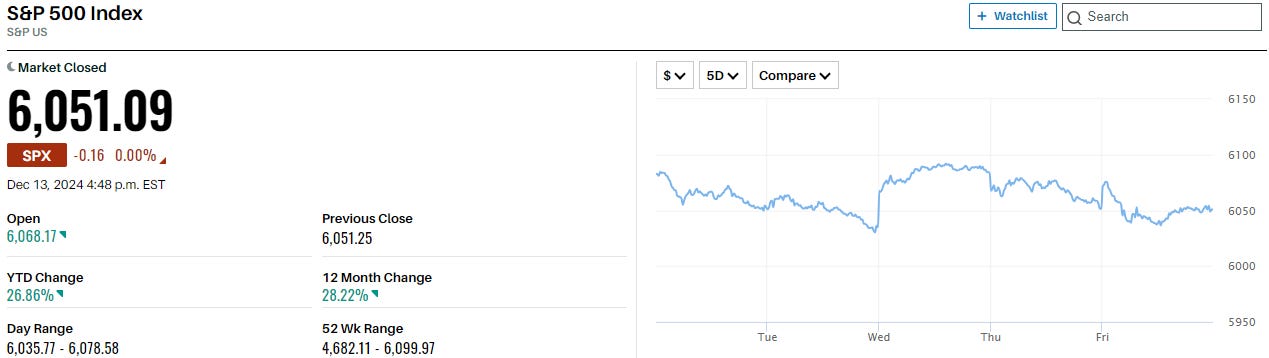

The S&P 500 back tracked on some of the gains earlier this month that pushed the index above 6,000 for the first time ever.

Some of the bigger movements this week included AVGO 0.00%↑ the semiconductor company which reported revenue about 50% higher than last year. They also included information on the market opportunity for accelerators to expand to about 70 billion by 2027. Semiconductors continue to show their importance with these massive leaps in revenue. Broadcom supplies solutions for data centers and storage for cloud computing some companies like AMZN 0.00%↑ MSFT 0.00%↑ and GOOG 0.00%↑ are continuing to invest heavily.

The spending of the big tech companies on this new build out for data centers has been insane. Some reports have said up to $60 billion in capital expenditures and growing at a 20% CAGR until 2028. Investors will ultimately be looking for these investments to generate a return showing up in operating earnings and free cash flow. Like every financially euphoric run (2008, 2000, 1970’s, 1920’s) it ends when the return no longer justifies the spending.

Switching gears to housing, we continue to face a massive under supply of homes, mixed with higher-than-normal rates which has forced buyers to pay up for homes, and sellers to be comfortable waiting to move. RH 0.00%↑ reported strong earnings this week which pushed the stock up about 17% and said they are expecting strong fourth quarter demand (highly discretionary furniture) despite “the worst housing market in 30 years”. I am still holding DHI 0.00%↑ hoping the demand for single family homes comes back into balance.

Debt and Rates

If you haven’t ever seen it, go check out the Global Debt Clock.

It will show you the largest budget items for the US and maybe worry you to death.

The US has issued about $2 trillion on a rolling basis over the last 12 months.

Check out this article on some of the spending from the Biden administration.

The green energy push alone had cost almost 1/4 of $1 trillion.

With interest rates dropping, inflation becomes a worry again as spending would increase and debt would be taken on. Increasing rates would force the US government to continue to issue debt at high rates, which hasn’t stopped it in the past, but is a looming worry.

This part of the letter sounds cynical, but I think of it more as potential factors to keep an eye on, or things that could be cracks as you mainly hear about AI related spec companies that can do no wrong.

Conclusion

Remember Benjamin Graham’s quote on the markets, in the short term the market is a voting machine, in the long term the market is a weighing machine.

Right now, AI is the vote and thus is being rewarded with high valuation. Over the long-term companies that continually return a higher rate on invested capital inside of the business will outperform companies with speculative investments or diminishing competitive advantages and bad leadership.

Thank you for tuning in this morning, have a restful weekend!